With the implementation planning window for the Financial Conduct Authority (FCA) Consumer Duty now well underway, the regulator published in January 2023 (halfway mark) the findings of its multi-firm review around the resilience of Duty implementation plans. They have since published sector-specific “Dear CEO” letters setting out their expectations from the top. They are now surveying 600 smaller firms.

Senior managers were reminded of their responsibilities and priorities:

“We expect the Consumer Duty to be a top priority for you personally. We want good outcomes for customers to be at the heart of firms’ strategies and business objectives, and leaders have a key role to play here. Firms’ Boards and senior management should embed the interests of customers into the culture and purpose of the firm.”

The FCA is supporting their activity with events and podcasts, with a recent one focused on consumer outcomes and avoiding ‘sludge practices’. Many will be interested in real examples of sludge practices and common consumer frustrations around ‘call wait times’ for non-sales activity and existing customers getting worse outcomes, in terms of fair value, when compared to prospective new customers, as was evident with regulator interventions in motor and home insurance in early 2022.

The narrative in speeches, non-handbook guidance (e.g. FG22/5), “Dear CEO” letters and other messaging is that we have moved on from the pandemic and are now in a cost-of-living crisis. The focus on the identification and treatment of vulnerable customers has never been higher, along with fraud prevention and scam awareness. These all become part of the ‘new mix’ in terms of customer engagement and customer experience (CX). The use of ‘friction’ in customer journeys should be in the customer’s best interests and not designed to stop them making an informed decision (e.g. switch product, complain).

FCA podcast[1] quote

“What we expect is firms to review their customer journeys and look out for frictions along the way, considering the impact on customers. So, asking what is this friction point doing? Is it there to protect customers from harm and nudge them to make the right decisions or is it just making customers’ lives more difficult by getting them to jump through hoops to do something that’s likely to benefit them. It’s the outcome here that really matters, so again firms monitoring will be important in helping them understand how customers behave and respond to different journeys and whether they’re driving the right outcomes.”

“And now that spring is in the air, have you done your spring cleaning of any sludge practices that are lingering? Are there any cobwebs of bad practice that need clearing? Any punitive exit fees or unfair charges that need eradicating?”

Call of Duty speech: How putting customers front and centre will help industry innovate – 22/2/2023

FCA Outcome Metrics

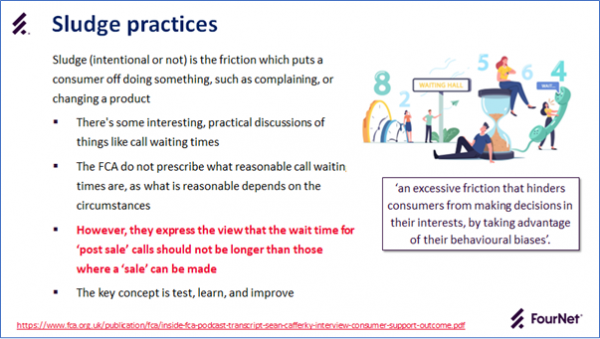

The FCA believe that the digitalisation of Financial Services is changing the way consumers make decisions and how ‘key actors’ in the market operate. Regulated firms must take a very pro-active approach to stay ahead of the regulator with regard to identifying potential harms, whilst exploiting the benefits from a competitive position. The FCA is looking at metrics[2] (e.g. SDM1-M01), for example how best to measure supervisory effectiveness in addressing digital ‘sludge’. Harmful digital choice architecture can make it difficult for consumers to make decisions that are in their best interest and for them to receive fair value. They have looked at assessment methods like using webscraping to inspect relevant websites, such as in BNPL, where the government has now proposed regulation[3] to bring this under the FCA supervision and with independent redress through the Financial Ombudsman Service.

The draft legislation sweeping in BNPL is expected to help protect around 10m customers, as providers could be required to give consumers key information about their loans and issue credit that is genuinely affordable. The BNPL sector nearly quadrupled during the pandemic in 2020 to £2.7 billion, and nearly £1 in every £8 spent online last month used BNPL services, according to Adobe Analytics.

FourNet looked at ‘digital transformation‘ under the Duty and some of the challenges of a ‘digital first’ approach in our recent report[4] entitled ‘Striking the right balance‘. The regulator has already highlighted in their non-handbook guidance (FG22/5) some of the risks that need to be mitigated where a digital first approach feels more like digital only with risks of customer exclusion and poor outcomes.

FourNet has discussed this with industry leaders through a series of Consumer Duty roundtable events in conjunction with our strategic partners, where presentations around how scaled platforms like NICE[5] Enlighten AI for vulnerable customers can be deployed alongside existing legacy infrastructure. Using Enlighten AI, regulated firms can objectively and accurately identify these customers on chosen voice and digital interactions out-of-the-box. Speed of deployment is critical given the short Duty deadlines. Supporting vulnerable customers[6] is a priority and FourNet is looking to embed key tools like the Vulnerability Registration Service (VRS) to enable tailored customer journeys.

A key aspect around the FCA focus on sludge practices is getting the balance between front-office and back-office investment right, where critical tests can be applied once a customer has been onboarded. This extends to vulnerable customers, where the regulator expects them to receive outcomes as good as the general customer population aligned to the firm’s risk appetite and target markets. The back office should be the ‘beating heart’ of a firm, so cultivating employee success is just as important as in the front office. This forms the foundations for a performance culture where customers can expect consistent results throughout the product or service lifecyle, including ancillary services (e.g. premium finance supporting a policy where the customer is on a low income and needs to pay by instalments).

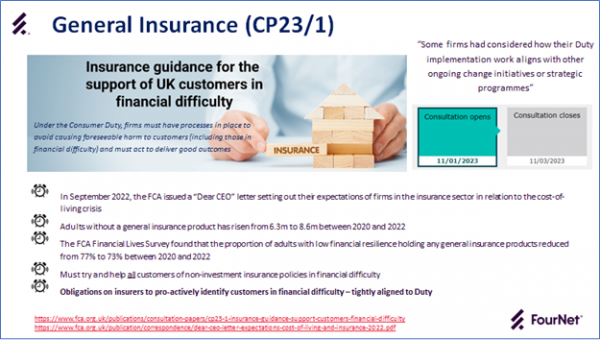

The FCA has recently issued a consultation (CP23/1) to general insurers around dealing with insurance customers in financial difficulty. Sludge practices may include not offering eligible policyholders the option of no interest instalment options through NILS providers. It may extend to not pro-actively engaging with policyholders where there is a risk of a critical insurance cover being dropped. This has been subject to a separate Blog looking at data-driven strategies to mitigate these risks.

There are many drivers of digital transformation; whether your aim is to enhance customer service, increase service capacity, improve employee productivity, streamline operations, address compliance issues, complaint handling, cancellation processes or accelerate innovation, FourNet can help.

FourNet and its strategic partners are experts at transitioning legacy processes (e.g. ‘on prem’ to cloud) and technology and can turbocharge your digital transformation journey in key areas of strategic change:

- Increased service capacity delivering better customer experience and reduced risks of perceived sludge practices

- Reduced cost to serve for routine/non-value activities (including agent-assist)

- Enhanced customer service/experience

- Streamlined customer journeys, with prioritization for high-risk customer segments

- Increased employee wellbeing & productivity

- Accelerated innovation & agile deployment

- Regulatory compliance & reputation management

‘Sludge prevention’ is likely to be focused in service delivery areas where ‘excessive friction’ is evident in stopping a customer achieving their objectives. Firm initiated channel switching policies influence this.

FourNet is committed to deployment of disruptive technologies (e.g. Conversational AI, machine learning, speech analytics, chatbots, robotics) that enable Duty and hybrid-working projects to be delivered with more certainty and agility. We partner with best-in-class providers as part of our over-arching proposition.

Knowing your target market is a key aspect of the FCA expectations and the FourNet CX Discovery Engagement gap analysis is a critical ‘assurance’ step in preparing for the Duty checkpoint at the end of April 2023 and the implementation date of 31 July 2023. Risk appetite is important in this respect and extensive data analytics are required to establish a basis for measuring consumer outcomes and detecting where potentially poor outcomes may emerge.

Supply chains were a key risk area that FCA identified in their Duty review with major firms and that insufficient attention had been paid to engaging with distribution chain partners, notably those that directly engage with customers and take manufacturer products to market (e.g. Brokers, dealers, appointed representatives for Principle firms).

Customer outcome testing is one of the core delivery mechanisms for the Duty to provide assurance that firms are consistently delivering good outcomes for their customers and are aligned to regulatory expectations. Technology will enable firms to evidence that they are meeting the new standards. This should include seasonal service peaks, overflow capacity, deployed deflection strategies, incident management (e.g. channel outages) and feedback from product design forums with customers or their advocates in terms of service support.

The FCA has highlighted key consideration factors to ensure it delivers good customer outcomes and to mitigate the risk of sludge practices. FourNet recognises that budgets are shrinking while performance and compliance demands are growing. Hybrid working adds additional risk management complexity.

In particular, firms should consider the following points:

- Communicating the support available, including accessibility options

- Ensuring support works effectively for all customer segments

- Dealing with non-standard issues

- Operational resilience – alternatives in the event of outages

- Customers with protected characteristics

- Customers with changing needs

Assess your Consumer Duty Readiness with a Customer Experience Data Consultation

Why FourNet?

| Delivering Digital Transformation

FourNet will help our customers deliver their digital transformation goals to enhance customer experience, improve employee productivity, streamline operations, address compliance issues, stay ahead of competitors and accelerate innovation through rapid diagnostic using data science & operational analysis. Improved Customer Experience We help deliver an enhanced customer experience through data-driven transformational CX consultancy, enabling customer self-service and offering true omnichannel contact center capabilities, giving customers increased customer satisfaction, ensuring retention and improving engagement. Increased Agility FourNet’s sprint methodologies combined with our stable, established Agile Cloud/ANTENNA Cloud platforms can help our clients quickly transition to the cloud, unlocking increased flexibility and speed to adopt new solutions and innovate. Risk Mitigation Our Project Managers are trained in both Agile and Prince2 methodologies and will agree the right approach that meets our clients risk profile and timescales. Underpinned with our cyber & networking security division, FourNet reduce risk for both organisations and their customers. |

| Data Driven Decisions

FourNet’s data science capability help our clients process and analyse internal data to prioritise the right decisions and initiatives to deliver improved CX, drive effective digital transformation, reduce costs through increase operational efficiency, increased adoption and improve collaboration enabling them to better measure and drive ROI. Process Efficiencies Utilising FourNet’s CX Consultancy, we help our clients improve their overarching customer experience, deliver operational efficiency, reduce churn, improve employee engagement and drive greater satisfaction by transforming and streamlining their business processes. Processes are mapped, analysed and optimised to deliver your strategic goals. Responsible Business As an industry leader in working towards net zero, delivering social value to our public sector customers; FourNet will work collaboratively with our clients to understand their Environmental, Social and Governance (ESG) priorities and ensure our solution helps them achieve them. |

Useful Guides